What is a trust and how does it work in New Jersey?

A trust is a legal arrangement where a person, known as the grantor or settlor, transfers their assets to another person or entity, known as the trustee, to manage and distribute those assets to beneficiaries according to the terms of the trust document. In New Jersey, trusts are governed by state law and can be created for various purposes, such as estate planning, asset protection, and charitable giving. Trusts in New Jersey must follow the terms outlined in the trust document. The grantor specifies the beneficiaries who will receive the trust assets and outlines any conditions or restrictions on their distribution. The trustee has a fiduciary duty to administer the trust following these terms and act in the best interests of the beneficiaries. Trusts can be revocable or irrevocable. A revocable trust allows the grantor to retain control over the assets during their lifetime and make changes or revoke the trust if desired. On the other hand, an irrevocable trust cannot be modified or revoked without the consent of all beneficiaries. This type of trust offers better asset protection but limits flexibility for the grantor.

Revocable Trusts in New Jersey

Revocable trusts, or living trusts, are commonly used in New Jersey for estate planning purposes. With a revocable trust, you maintain control over your assets during your lifetime while designating how they should be managed and distributed after your death. This type of trust allows you to avoid probate court proceedings and keep your financial affairs private.

Advantages of a Living Trust:

- Flexibility: You have the ability to modify or revoke the trust at any time during your lifetime.

- Avoidance of Probate: Assets held within a revocable trust do not go through probate court proceedings upon your death, saving time and costs.

- Privacy: Unlike a will, which becomes public record upon probate, the terms of a revocable trust remain private.

Disadvantages of a Living Trust:

- No Asset Protection: Since you retain control over the assets in a revocable trust, they are not protected from creditors or lawsuits.

- Tax Considerations: Revocable trusts do not provide any tax benefits or protections. The assets within the trust are still considered part of your estate for tax purposes.

Irrevocable Trusts in New Jersey

Irrevocable trusts are another option available in New Jersey. With an irrevocable trust, you permanently transfer your assets to the trust, relinquishing control over them. This type of trust offers greater asset protection and potential tax benefits but requires careful consideration due to its irrevocability.

Advantages of an Irrevocable Trust:

- Asset Protection: Assets held within an irrevocable trust are generally protected from creditors and lawsuits.

- Estate Tax Planning: By removing assets from your estate, you can potentially reduce estate taxes that may be imposed upon your death.

- Medicaid Planning: Transferring assets into an irrevocable trust may help protect them from being counted for Medicaid eligibility purposes.

Disadvantages of an Irrevocable Trust:

Loss of Control: Once assets are transferred to an irrevocable trust, you no longer have control over them.

Inflexibility: Changes to the terms of an irrevocable trust usually require the consent of all beneficiaries.

Tax Considerations: While irrevocable trusts can offer tax advantages, they also have complex tax rules and regulations that must be carefully navigated.

Choosing the Type of Trust

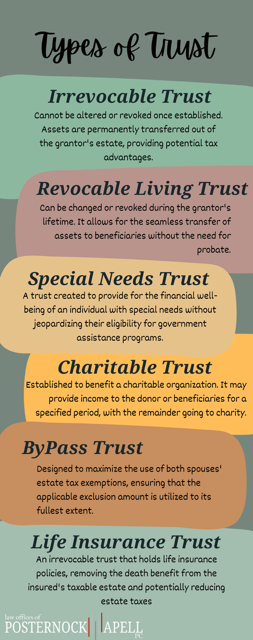

When establishing a trust in New Jersey, one of the first decisions you will need to make is choosing the type of trust that best suits your needs. New Jersey recognizes several types of trusts, including revocable living trusts, irrevocable trusts, charitable trusts, and special needs trusts.

Revocable living trusts: Also known as inter vivos trusts, these can be modified or revoked by the grantor during their lifetime. They provide flexibility and control over assets while allowing for probate avoidance.

Irrevocable trusts: Once established, these cannot be changed or terminated without the consent of all beneficiaries. Irrevocable trusts offer asset protection and potential tax benefits.

Charitable trusts: These are designed to benefit charitable organizations while providing potential tax advantages to the grantor. Charitable remainder trusts and charitable lead trusts are common examples.

Special needs trusts: These are created to provide for individuals with disabilities without impacting their eligibility for government assistance programs like Medicaid. They ensure funds are managed and distributed appropriately for the beneficiary’s benefit.

The Importance of Consulting an Attorney

Establishing a trust involves complex legal processes and considerations. Therefore, it is crucial to consult an experienced attorney specializing in estate planning and trust law in New Jersey. An attorney can guide you through the process, ensuring your trust is properly drafted and executed according to state laws.

Evaluating Your Estate Planning Goals

Before establishing a trust in New Jersey, it is essential to evaluate your estate planning goals. Consider what assets you want to include in the trust, who will be the beneficiaries, how you want those assets to be managed and distributed, and any specific instructions or conditions you wish to impose.

Additionally, consider potential tax implications and how the trust can help minimize estate taxes. By clearly defining your goals, you can work with your attorney to create a trust that aligns with your wishes and maximizes the benefits for you and your beneficiaries.

- Research different types of trusts available in New Jersey

- Consult an experienced attorney specializing in estate planning

- Evaluate your estate planning goals, including asset inclusion, beneficiaries, and instructions

- Consider potential tax implications and ways to minimize estate taxes

Charitable Trust

A charitable trust is a type of trust that allows individuals to support charitable organizations or causes while also receiving certain tax benefits. In New Jersey, there are two main types of charitable trusts: charitable lead trusts and charitable remainder trusts.

Charitable Lead Trust:

In a charitable lead trust, the income generated from the trust is directed to a charity for a specified period of time. After that period ends, the remaining assets in the trust are passed on to non-charitable beneficiaries, such as family members or other individuals.

Charitable Remainder Trust:

Conversely, in a charitable remainder trust, the income generated from the trust is paid to non-charitable beneficiaries for a specified period of time. After that period ends or upon the death of the non-charitable beneficiaries, the remaining assets in the trust are transferred to one or more charitable organizations. Both types of charitable trusts offer tax advantages by allowing individuals to receive an income tax deduction for their donation to charity while still providing for themselves or their loved ones during their lifetime.

Modifying a trust in New Jersey

In New Jersey, it is possible to modify a trust if certain conditions are met. One way to modify a trust is through the use of a trust amendment. A trust amendment is a legal document that allows the settlor, or creator of the trust, to make changes to the original terms of the trust. The amendment must be executed with the same formalities as the original trust document and should clearly state the modifications being made.

Another option for modifying a trust in New Jersey is through a complete restatement of the trust. This involves creating a new trust document that replaces and supersedes the original one. The restated trust should include all of the desired changes and should clearly state that it is intended to replace the original trust.

Trust Amendment Requirements

To ensure that a trust amendment is valid in New Jersey, the legal requirements must be met:

- The amendment must be in writing.

- The amendment must be signed by the settlor or an authorized representative.

- The amendment should reference the original trust document and clearly identify which provisions are being modified.

- The amendment should be properly witnessed and notarized.

Effect of Trust Amendment

A validly executed trust amendment has legal effect and becomes part of the overall estate plan. It allows for flexibility in changing specific provisions of a trust without having to create an entirely new one. However, it’s important to note that not all provisions can be modified through an amendment. Some fundamental aspects, such as naming beneficiaries or changing trustees, may require more extensive steps like creating a new trust or revoking the existing one.

Benefits of creating a trust in New Jersey

1. Asset Protection

Creating a trust in New Jersey offers significant asset protection benefits. By transferring assets into a trust, they are no longer considered personal property and are protected from creditor claims or potential lawsuits. This can be particularly advantageous for individuals with high-risk professions or those who want to protect their assets for future generations.

Trustee’s Discretionary Powers

One of the key advantages of creating a trust in New Jersey is the ability to grant discretionary powers to the trustee. This means the trustee can decide how and when the trust assets are distributed to beneficiaries. By giving this discretion, you can ensure that your beneficiaries receive financial support according to their individual needs and circumstances. Another advantage is that discretionary powers allow the trustee to adapt and adjust distributions based on changing circumstances, such as unforeseen financial hardships or emergencies. This flexibility ensures that your loved ones are cared for, even in unpredictable situations.

2. Estate Tax Planning

New Jersey has its own estate tax laws, which may impact your estate planning strategies. However, creating a trust can provide effective solutions for minimizing estate taxes.

Avoidance of Probate

By establishing a trust, you can avoid probate proceedings for certain assets upon your death. Probate can be time-consuming, costly, and subject to public scrutiny. With a properly funded trust, your assets can pass directly to your designated beneficiaries without going through probate court. Additionally, trusts offer privacy since they are not subject to public record like wills filed with probate courts. This confidentiality helps keep sensitive family information and asset details private.

Generation-Skipping Transfer Tax Exemptions

In New Jersey, trusts also provide opportunities for generation-skipping transfer tax exemptions. This means you can transfer assets to your grandchildren or future generations without incurring excessive tax burdens. By utilizing these exemptions, you can preserve wealth within your family and ensure a lasting financial legacy. In summary, creating a trust in New Jersey offers asset protection benefits through discretionary powers granted to the trustee and helps with estate tax planning by avoiding probate and utilizing generation-skipping transfer tax exemptions. These advantages make trusts an effective tool for managing and distributing your assets according to your wishes while protecting them for the future.

Income Tax

In New Jersey, trusts are subject to income tax at the state and federal levels. The income generated by a trust is typically taxed at the trust level rather than being passed through to the individual beneficiaries. The tax rate for trusts in New Jersey varies depending on the amount of taxable income. Trusts with lower taxable income may be subject to a lower tax rate, while those with higher taxable income may face a higher tax rate. Trustees must carefully manage and report the income generated by the trust to comply with state and federal tax laws.

Deductions and Credits

Trusts in New Jersey may be eligible for certain deductions and credits that can help reduce their overall tax liability. Some common deductions include expenses related to administering the trust, such as legal fees or accounting costs. Additionally, trusts may be able to claim credits for taxes paid to other states or countries on income earned outside of New Jersey. These deductions and credits can significantly impact the final tax liability of a trust, so the trustees must work closely with a qualified accountant or tax professional to ensure all eligible deductions and credits are claimed.

Alternative Minimum Tax

Trusts in New Jersey may also be subject to the Alternative Minimum Tax (AMT). The AMT is an additional tax calculation that ensures individuals and entities with high incomes pay a minimum amount of taxes, regardless of available deductions and credits. If a trust’s calculated AMT exceeds its regular income tax liability, it must pay the higher amount. Trustees should carefully review their trust’s financial situation each year to determine if they are subject to AMT and plan accordingly. Some key considerations when managing the tax implications of trusts in New Jersey include keeping detailed records of all income, expenses, deductions, and credits; understanding any changes in state or federal tax laws that may impact trusts; and consulting with a knowledgeable tax professional to ensure compliance and optimize tax planning strategies.

Choosing a Trustee with Knowledge and Experience

When selecting a trustee for your trust in New Jersey, choose someone with the necessary knowledge and experience to manage your assets effectively. The trustee will be responsible for making financial decisions, investing assets, and distributing funds according to the terms of the trust. Ideally, you want someone who is familiar with estate planning laws in New Jersey and has a background in finance or law.

Consider Professional Trustees

An option worth considering is hiring a professional trustee. These are individuals or institutions that specialize in managing trusts and have extensive experience in handling complex financial matters. They have a fiduciary duty to act in the best interests of the beneficiaries and can provide expertise in areas such as tax planning, investment management, and legal compliance.

Pros of Professional Trustees:

- Expertise: Professional trustees have specialized knowledge and experience in managing trusts.

- Objectivity: They can make impartial decisions based on the terms of the trust.

- Continuity: Unlike individual trustees who may pass away or become incapacitated, professional trustees ensure continuity by having multiple staff members who can step in if needed.

Evaluating Personal Trustees

If you prefer to appoint a personal trustee for your trust, there are several factors to consider when evaluating potential candidates. Firstly, assess their ability to handle financial matters responsibly. Look for individuals who have demonstrated good judgment with their own finances or have experience managing financial affairs for others.

Family Members as Trustees

A common choice for many people is appointing a family member as their trustee. This can work well if the family member possesses the necessary skills and integrity required for the role. However, it is essential to consider potential conflicts of interest and family dynamics that may arise. It is crucial to choose someone who can separate their personal interests from their fiduciary duties.

Factors to Consider when Choosing a Family Member as Trustee:

- Trustworthiness: Ensure the family member has a reputation for honesty and integrity.

- Availability: Assess whether the individual has the time and availability to fulfill their trustee responsibilities.

- Communication Skills: Effective communication is vital for managing a trust, so consider someone who can communicate clearly with beneficiaries and other involved parties.

Benefits of Asset Protection Trusts

What is an Asset Protection Trust?

An asset protection trust is a legal arrangement that allows individuals to protect their assets from potential creditors. In New Jersey, this type of trust can provide individuals with added security and peace of mind by safeguarding their wealth and property.

How Does an Asset Protection Trust Work?

When setting up an asset protection trust in New Jersey, the individual (known as the grantor) transfers ownership of their assets to a trustee. The trustee then manages these assets on behalf of the beneficiaries, who are typically the grantor’s family members or loved ones. By placing the assets in the trust, they are shielded from potential creditors seeking to collect debts.

The Benefits:

1. Creditor Protection

One of the primary advantages of establishing an asset protection trust in New Jersey is its ability to safeguard assets from creditors. If a creditor attempts to pursue a claim against the grantor, they will find it challenging to access assets held within the trust. This protection can be particularly valuable for individuals engaged in high-risk professions or those facing potential litigation.

2. Estate Planning Benefits

Asset protection trusts also offer estate planning benefits. By transferring assets into a trust, individuals can ensure that their wealth is distributed according to their wishes after their passing. This can help minimize probate costs and delays while maintaining privacy for the grantor and beneficiaries.

3. Flexibility and Control

Asset protection trusts provide flexibility and control over how assets are managed and distributed. The grantor can establish specific guidelines for when and how beneficiaries receive distributions from the trust, ensuring that funds are used appropriately and according to their intentions.

Establishing an asset protection trust in New Jersey offers numerous benefits, including creditor protection, estate planning advantages, and asset management flexibility. By utilizing this legal tool, individuals can protect their hard-earned wealth and preserve it for future generations.

Administration of the trust

After the grantor’s death in New Jersey, the administration of the trust is carried out according to the terms and provisions outlined in the trust document. The appointed trustee or successor trustee takes on the responsibility of managing and distributing the assets held within the trust. The trustee must adhere to their fiduciary duty, acting in the best interests of the beneficiaries and following any specific instructions outlined in the trust.

Appointment of a successor trustee

If the grantor named themselves as the initial trustee, they would have also designated a successor trustee who would take over upon their death. This individual or entity assumes control over managing and distributing the trust assets. It is essential for a successor trustee to be aware of their responsibilities and have knowledge about estate planning laws and regulations in New Jersey.

Duties of a successor trustee

The duties of a successor trustee include gathering all necessary documentation, such as death certificates and copies of the trust agreement, notifying beneficiaries about their rights, handling tax matters related to the trust, evaluating and managing assets within the trust, paying off any outstanding debts or expenses, and ultimately distributing assets to beneficiaries according to the terms outlined in the trust document.

Distribution of assets

Once all administrative tasks are completed, it is time to distribute assets from the trust. The timing and manner in which this occurs depend on various factors specified by the grantor. Some trusts may provide for immediate distribution upon death, while others may stipulate delayed distributions based on certain conditions or ages reached by beneficiaries.

Types of distributions

- Lump-sum distribution: A grantor may specify that all trust assets be distributed at once as a lump sum to beneficiaries.

- Periodic distributions: A trust may allow for periodic distributions, such as annual or monthly payments, to provide ongoing financial support to beneficiaries.

- Conditional distributions: The grantor may establish certain conditions that must be met before assets are distributed, such as reaching a certain age or achieving specific milestones.

Tax implications of asset distribution

You should be aware of the tax implications of asset distribution from a trust in New Jersey. Depending on the nature of the assets and the timing of distributions, beneficiaries may be subject to income tax or estate tax. Seeking guidance from a qualified tax professional can help ensure compliance with applicable tax laws and minimize potential tax burdens.

Requirements for Trust Creation

Capacity to Create a Trust

In New Jersey, the person creating a trust, known as the settlor, must have the legal capacity to create a trust. This means they must be of sound mind and at least 18 years old. If the settlor lacks capacity due to mental illness or disability, the trust may be challenged in court. The settlor should consult an attorney to ensure they meet the legal requirements for creating a valid trust.

Example: Mental Capacity

To establish mental capacity, it is necessary for the settlor to understand the nature and consequences of creating a trust. They should comprehend the assets being placed in the trust, how those assets will be managed or distributed, and who will act as trustee. If there are concerns about mental capacity, it may be advisable to obtain medical evaluations or seek professional advice from experts in assessing mental competence.

Intent to Create a Trust

Another essential requirement is that the settlor clearly intended to create a trust. This means they must express their intention through words or conduct that demonstrates their purpose of transferring property ownership to another person (the trustee) for the benefit of one or more beneficiaries. The settlor’s intent should be clearly written through a trust agreement or declaration.

Example: Expressing Intent

The intent can be expressed explicitly by stating, “I hereby create a trust,” or implicitly by transferring property into an existing trust. However, it is crucial for the settlor’s intent to be unambiguous and unequivocal so that there is no confusion regarding their wishes. Consulting with an experienced attorney during this process can help ensure that all necessary elements are met and that the settlor’s intentions are accurately reflected in the trust document.

Identifiable Trust Property

For a trust to be valid, the property being transferred into the trust must be identifiable. This means the assets must be clearly described or identifiable by specific characteristics. It is essential to provide detailed information about the property, such as its location, description, and any relevant identifying numbers.

Example: Describing Property

For instance, if the trust includes real estate, the property should be identified by its address and legal description. If it involves financial assets like stocks or bonds, their specific names, quantities, and account numbers should be provided. By ensuring clear identification of trust property, potential disputes or confusion can be minimized in the future. Creating a valid trust in New Jersey requires meeting these legal requirements related to capacity, intent, and identifiable property. It is advisable for individuals considering establishing a trust to seek guidance from an experienced attorney who can assist in drafting a comprehensive and legally sound trust document.

Identifying and notifying beneficiaries

After the grantor died in New Jersey, one of the first steps in administering a trust is to identify and notify the beneficiaries. The trustee must review the trust document to determine who the beneficiaries are and gather their contact information. Once this is done, the trustee should send a formal notice to each beneficiary informing them of their rights under the trust. This notice should include details about how and when distributions will be made, any conditions or restrictions on distributions, and how they can communicate with the trustee.

Creating an inventory of trust assets

Another crucial aspect of administering a trust after the grantor’s death is creating an inventory of all the trust assets. The trustee must locate and document all properties, investments, bank accounts, and other assets held within the trust. This may involve gathering financial statements, deeds, titles, and other relevant documents. The trustee will need to maintain accurate records of these assets as it will help in properly managing and distributing them according to the terms of the trust.

Distributing trust assets

Once beneficiaries have been identified and an inventory of trust assets has been created, it is time for the trustee to distribute those assets. The distribution process should align with the instructions outlined in the trust document. Depending on the terms set forth by the grantor, distributions may be made in a lump sum or over a period of time. The trustee must ensure that all necessary legal requirements are met during this process.

Accounting for income and expenses

As part of administering a trust after a grantor’s death in New Jersey, trustees are responsible for accounting for all income received by the trust and any expenses incurred during its administration. This includes keeping track of rental income from properties held within the trust, dividends from investments, interest from bank accounts, and any other sources of income. Additionally, the trustee must document any expenses related to managing the trust, such as legal fees or property maintenance costs. Keeping accurate records of income and expenses is essential for transparency and to fulfill fiduciary duties.

Preparing and filing tax returns

Trustees are also responsible for preparing and filing tax returns on behalf of the trust after the grantor’s death in New Jersey. This includes both federal and state tax returns, as well as any necessary inheritance or estate tax filings. It is a good idea for trustees to seek professional advice from accountants or tax attorneys to ensure compliance with all applicable tax laws and regulations. Failing to file taxes correctly can result in penalties or legal consequences.

Resolving disputes or challenges

In some cases, disputes or challenges may arise during the administration of a trust after the grantor’s death in New Jersey. These could involve disagreements among beneficiaries regarding distributions, questions about the interpretation of provisions in the trust document, or allegations of misconduct by the trustee. When faced with such situations, it is advisable for trustees to get legal guidance to help resolve these issues amicably and in accordance with state laws.

Finalizing the trust administration

Once all necessary tasks have been completed, including identifying beneficiaries, distributing assets, accounting for income and expenses, filing taxes, and resolving any disputes, it is time to finalize the trust administration process. This typically involves obtaining releases from beneficiaries confirming their receipt of their rightful share from the trust and acknowledging that they have no further claims against it. The trustee should also prepare a final accounting report detailing all actions taken during the administration period. Finally, once everything has been properly documented and approved by relevant parties, the trustee can close out the trust administration process.

Why transfer real estate into a trust?

Transferring real estate into a trust in New Jersey can benefit property owners. One primary advantage is avoiding probate, which is the legal process of distributing assets after someone passes away. By placing real estate into a trust, it bypasses probate and allows for a smoother and quicker transfer of ownership to beneficiaries.

Another advantage is the potential for reducing estate taxes. Placing real estate in a trust can help minimize the taxable value of an individual’s estate, ultimately resulting in lower tax liabilities for their heirs. Additionally, transferring real estate into a trust offers privacy since trust documents are not made public, like probate records, ensuring confidentiality regarding property ownership.

The process of transferring real estate into a trust

To transfer real estate into a trust in New Jersey, specific steps need to be followed. Firstly, it is essential to establish a revocable living trust, which allows the property owner to retain control over the assets during their lifetime while designating beneficiaries to inherit them upon their passing.

Once the trust is established, the property deed needs to be prepared and executed correctly. This involves drafting a new deed that transfers ownership from the individual’s name to that of the trust. The deed should comply with New Jersey’s legal requirements and include specific language indicating that it is being transferred into the established trust.

After preparing the deed, it must be signed by all relevant parties involved in the transfer, including both grantors (property owners) and trustees (individuals responsible for managing the trust). Finally, the signed deed must be recorded with the appropriate county clerk’s office where the property is located to ensure its legal validity.

Considerations when transferring real estate into a trust

Tax Implications

Before transferring real estate into a trust, it is crucial to consult with a tax professional or an attorney specializing in estate planning. Depending on the value of the property and individual circumstances, there may be potential tax implications associated with the transfer, such as gift taxes or capital gains taxes.

Title Insurance

When transferring real estate into a trust, it is advisable to review the existing title insurance policy. In some cases, a new policy may need to be obtained to ensure the property remains adequately protected under the trust’s ownership.

Mortgage Considerations

If the property being transferred into a trust has an existing mortgage, it is essential to notify the mortgage lender about the intended transfer. Some mortgages may contain due-on-sale clauses that could trigger acceleration of repayment if ownership changes without permission from the lender.

Asset Evaluation

Before transferring real estate into a trust, conducting a comprehensive evaluation of all assets involved is recommended. This assessment helps ensure that all necessary properties are properly included in the trust and aligned with an individual’s overall estate planning goals.

Overall, transferring real estate into a trust in New Jersey offers various advantages while requiring careful consideration of legal requirements, tax implications, and other relevant factors. Seeking guidance from professionals experienced in estate planning can help navigate this process smoothly and maximize its benefits.

Common types of Trust disputes

Disputes over the terms of a trust in New Jersey can arise for various reasons. One common type of dispute is when beneficiaries disagree on the interpretation or meaning of provisions within the trust document. This could include disagreements regarding the distribution of assets, the appointment of trustees or executors, or the inclusion or exclusion of particular beneficiaries.

Another common type of dispute is when there are allegations of undue influence or coercion in the creation or modification of the trust. This can occur when one beneficiary believes that another beneficiary or third party pressured the settlor (the person who created the trust) to make decisions that were not in their best interest.

Resolving Trust Disputes

In New Jersey, several options are available for resolving disputes over the terms of a trust. One option is mediation, where a neutral third party helps facilitate communication and negotiation between the parties involved. Mediation can be a cost-effective and efficient way to reach a mutually agreeable resolution.

If mediation is unsuccessful or not desired, litigation may be necessary. In this case, each party would present their arguments and evidence before a judge, who would ultimately make a decision on how to interpret and enforce the terms of the trust.

List of steps in resolving disputes:

- Gather all relevant documents related to the trust, including the trust itself, amendments, and correspondence between the parties involved.

- Consult with an experienced attorney specializing in trusts and estates law to understand your rights and options.

- Consider alternative dispute resolution methods such as mediation or arbitration before pursuing litigation.

- If litigation becomes necessary, file a complaint with the appropriate court and follow all procedural requirements.

- Engage in the discovery process, where each party exchanges relevant information and evidence.

- Participate in settlement negotiations or attend trial to present your case before a judge.

- Comply with any court orders or judgments regarding the resolution of the trust dispute.

Choosing a local Moorestown estate planning attorney

Creating trusts in New Jersey provides individuals with a means to safeguard their assets and find peace of mind. Trusts offer flexibility and control over asset management, allowing for efficient estate planning and avoidance of probate. Revocable trusts grant the grantor greater control, while irrevocable trusts provide enhanced asset protection and potential tax benefits. By establishing trusts, residents of New Jersey can secure their assets and ensure the smooth distribution of their wealth according to their wishes.

Here at Posternock Apell, we have decades of experience in estate planning. As a local Moorestown attorney, we understand the needs of our clients and how to safeguard their legacies. No matter the type of trust you need, we can help. Reach out to us today for a free consultation.